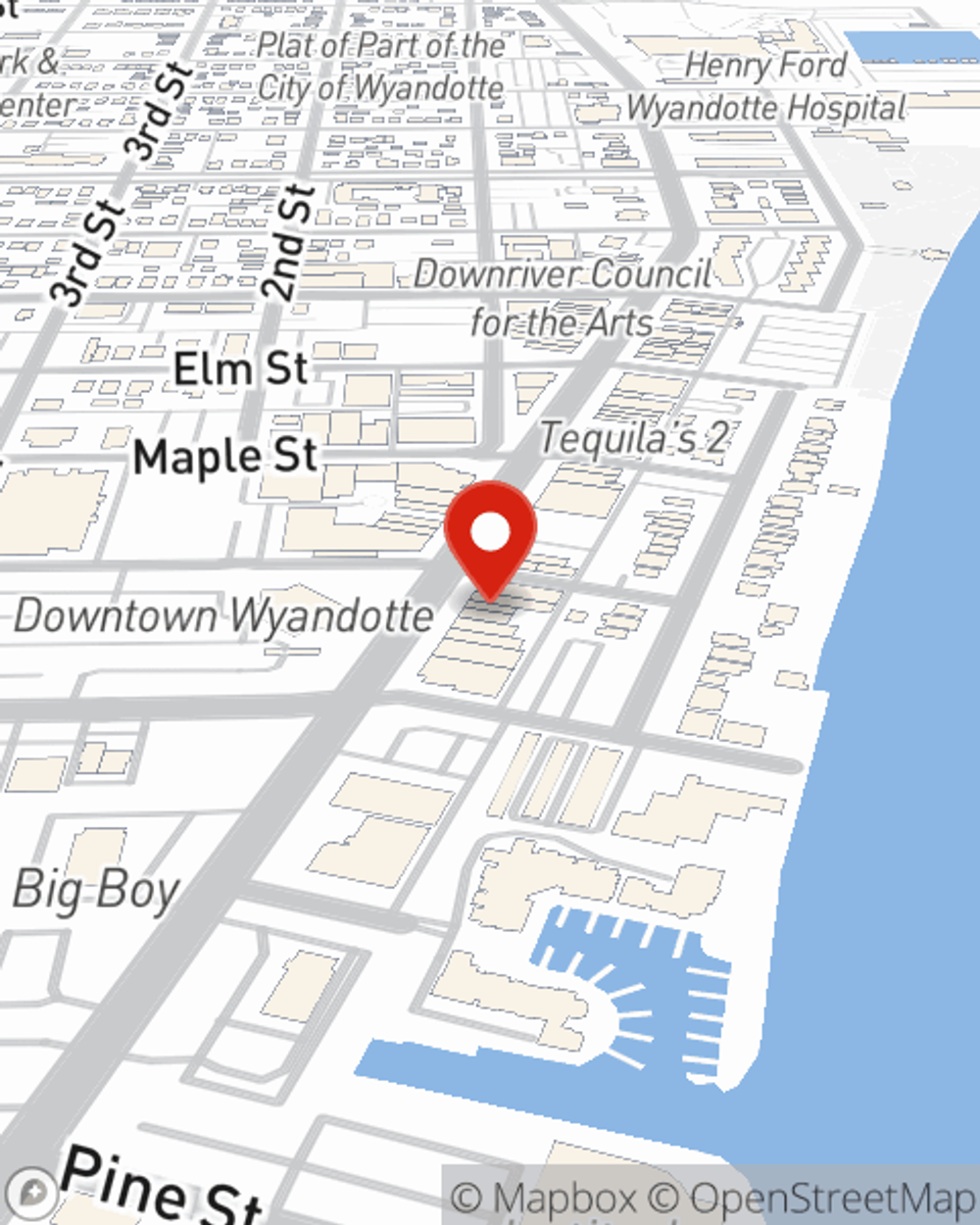

Life Insurance in and around Wyandotte

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Trenton

- Southgate

- Riverview

- Woodhaven

- Brownstown

- Gibraltar

- Metro Detroit

- Downriver

Your Life Insurance Search Is Over

No one likes to entertain ideas about death. But taking the time now to plan a life insurance policy with State Farm is a way to show care to your family if death comes.

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Life Insurance Options To Fit Your Needs

Having the right life insurance coverage can help loss be a bit less complicated for your family and allow time to grieve. It can also help meet important needs like retirement contributions, ongoing expenses and college tuition.

If you're looking for dependable insurance and considerate service, you're in the right place. Talk to State Farm agent Joe Vitale today to discover which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Joe at (734) 671-6511 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.